Welcome to it — Friday!

This week, I had the opportunity to co-host Windermere Way, and I want to give a special Friday shoutout to those who invested their time and energy into both mastery of self and mastery of craft.

The question for all of us now becomes:

How do we activate that investment?

P.S. Not everyone made it into the group photo, yet each of you played a huge role in filling the room with collaboration, growth, and, yes — The Windermere Way.

I’m here to help. The ultimate goal? Your growth, your clarity, and your confidence.

— Laura

Didn’t attend Windermere Way?

No worries at all. I’ll be weaving key content into your weekly updates — broken down in practical, digestible ways.

To kick things off, here’s a blog post that combines the latest insights from the May 2025 KCM Monthly Market Report and Federal Reserve updates — giving you a fully-informed, client-ready market message and a look at my focus heading into next week’s office meetings…

📣 Talking Point:

“Having the right conversation now builds trust and drives business. Value wins every time.”

👉 May 2025 Market Message for Agents: Talk Facts, Drive Confidence

Agents who have the most high-impact conversations right now are the ones winning. This month’s updates are packed with insights your clients need — from home prices and mortgage rates to Fed updates and economic uncertainty.

Let’s break it down into clear, actionable talking points.

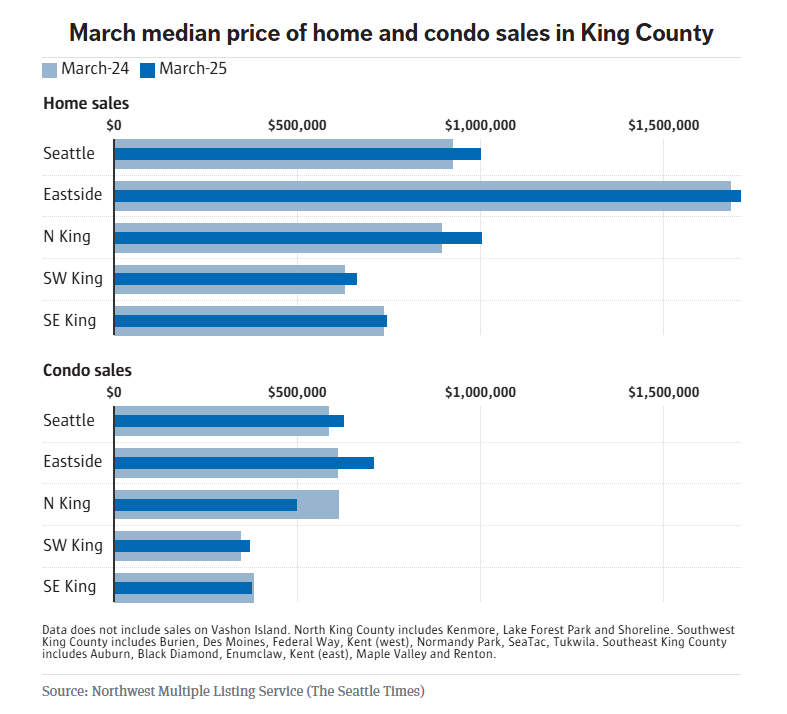

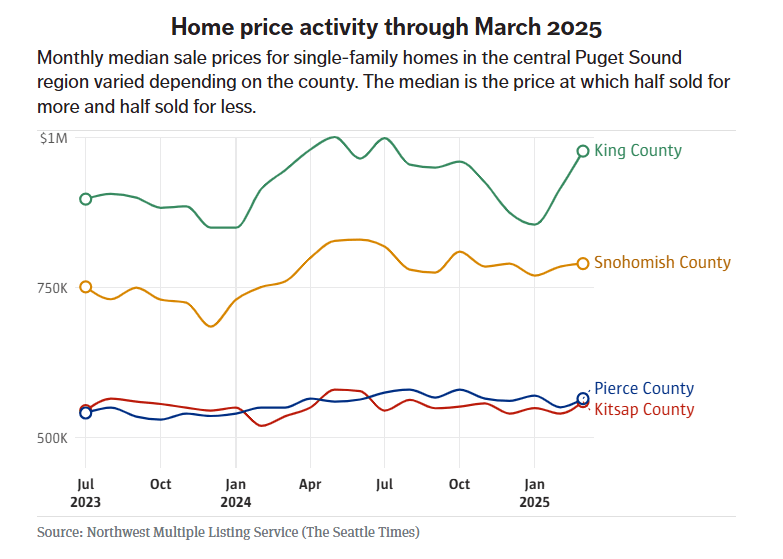

📊 1. Home Prices: No Crash Coming

- 70% of Americans are worried about a housing crash — but the data says otherwise.

- Inventory is up 30% year-over-year — but still 16% below pre-pandemic levels.

- Prices are moderating, not falling. National year-over-year growth is at 3.9%, down from 7% last year — a healthy adjustment.

📣 Talking Point:

“While inventory is improving, it’s still far below normal — meaning prices are stabilizing, not crashing.”

💰 2. Mortgage Rates: Volatility, Then Relief?

- April brought volatility — rates jumped from year-low to year-high in a single week.

- As of mid-May, the 30-year fixed average sits at 6.81% — the highest since late April.

- The Federal Reserve held rates steady at its May meeting, citing ongoing economic uncertainty.

- Fed Chair Powell warned of possible ongoing supply shocks (think: tariffs, inflation), suggesting rates may stay elevated longer.

📣 Talking Point:

“Yes, rates are elevated — but the Fed is holding for now, and even small drops could unlock big buyer and seller movement.”

🧠 3. Buyer/Seller Hesitation = Your Opportunity

- 1 in 4 buyers and 1 in 8 sellers are pausing due to fear or confusion.

- Most won’t call you — they’ll just quietly delay decisions.

📣 Talking Point:

“Let’s talk through what’s really happening — not what the headlines are saying.”

📌 5. Agent Action Plan This Week

- Reach out to 3 clients who may be on pause — ask: “What’s holding you back?”

- Post a short video or reel explaining why “price crash” fears are unfounded based on KCM talking points.

- Drop this line in convos: “I’ve been watching what’s happening — want the real scoop?”

📚 Bonus Insight: What I’m Doing in My Office meetings next week

To make Windermere Way content stick, we’re breaking it into bite-sized pieces at the branch level. Here’s what we’re rolling out next week:

- 🧠 “Switch tasking is a thief” — based on Deep Work by Cal Newport

- 📱 “Send Later” iPhone feature — tying into F.O.R.D. and the power of anticipation

- 🤖 AI brainstorm — practical, relevant uses in listings and lead gen

Final thoughts…

You don’t have to predict the market — just help people understand it.

You don’t need to push — just have more meaningful conversations.

You don’t need to do it alone — we’ve got the tools.

Let’s stay sharp, stay visible, and guide with facts. This is your market to win. 💥

And, please consider posting a comment on this blog post with your key ah-ha or actionable item – I am curious as I prep for next week!